At the end of every year, my office staff is inundated with questions about which insurance plan to choose for the following year. There are multiple insurance carriers and many different types of plans. If you receive insurance through an employer, each particular plan is customized to meet

Dental Benefit plans vary, but in general there are two basic types: managed care and fee-for-service. Managed care plans (PPOs and DHMOs) typically have lower premiums but have many restrictions on the types of treatment you can receive, and some pay only for treatment done by contracted dentists who have agreed to accept the insurance company’s reimbursement amounts. DHMO (Dental Health Maintenance Organization) plans and some PPO (Preferred Provider Organization) plans require patients to choose a dentist from a limited list of dentists and do not pay for work done by a dentist not on the list, so freedom of choice is inhibited. There are some PPO plans that do allow patients to receive treatment from a non-participating dentist. Those plans typically have higher deductibles and co-payments. Such a plan may pay, for example, 80% on a procedure done by a “participating” dentist but only 60% of the fee charged by a “non-participating” dentist. Fee-for-service, or “Direct Reimbursement,” plans typically have higher premiums but reimburse patients according to dollars spent on dental treatment and allow the patient to choose any dentist without strict guidelines on types of treatment that are covered.

Often y

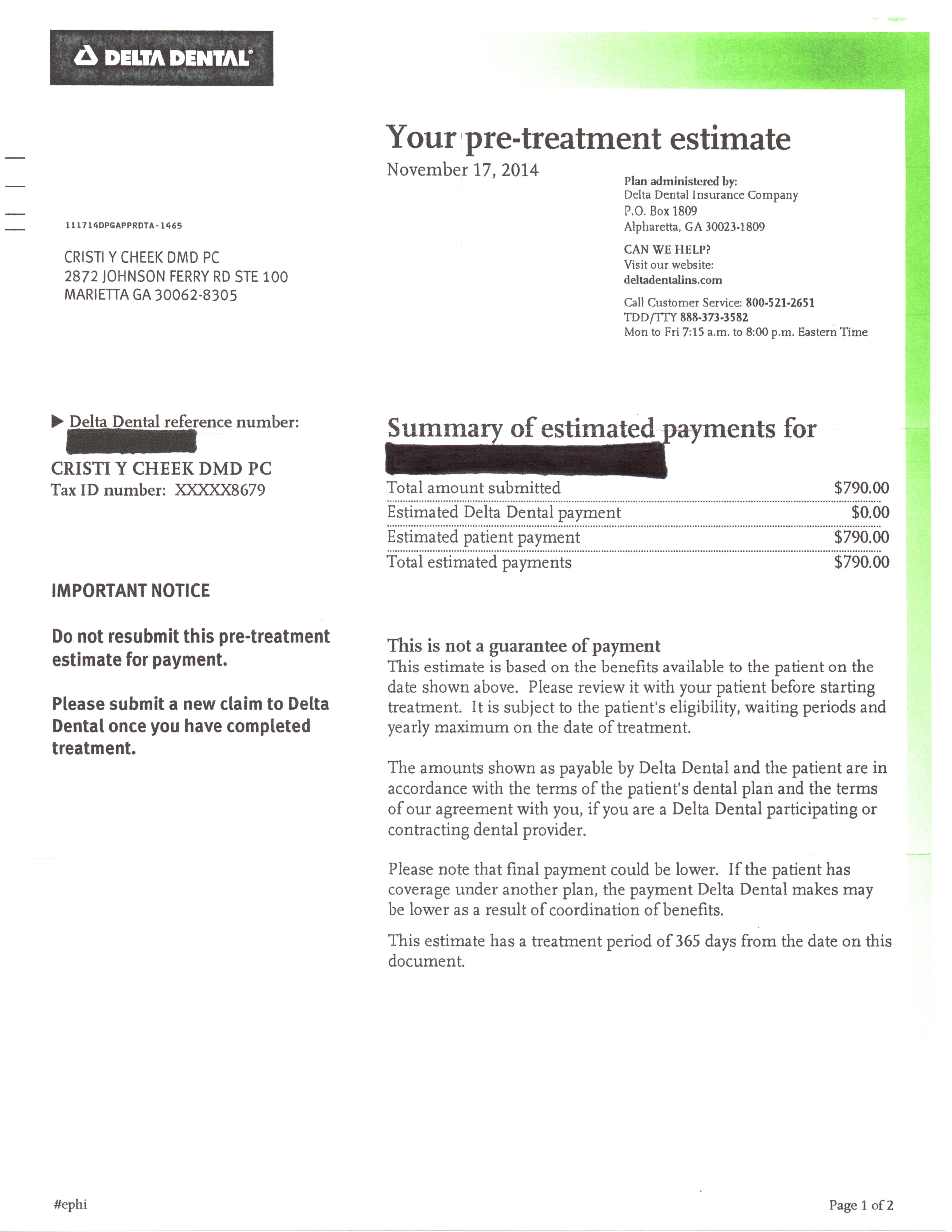

Many insurance plans have restrictions on treatment covered such as “pre-existing conditions,” “alternative minimum treatments,” and “waiting periods.” If you are missing a tooth before you purchase the insurance policy, a missing tooth clause will state that the insurance company will not pay for replacement of that tooth. If you are in need of a crown, an insurance company may require you wait 6 -12 months after purchasing the plan before they will pay for that service. Some plans may pay for what they consider to be the least expensive alternative treatment which may not be the most ideal treatment for you. For example, if you are missing one tooth on each side of your lower jaw and prefer to have 2 porcelain bridges or 2 implants placed, the insurance company may pay for only a removable partial denture since it is the lowest cost treatment to replace multiple missing teeth.

The yearly maximum benefit is the most money that the dental insurance plan will pay within one full year. If you have unused benefits, they will not roll over. Most dental insurance maximums are only around $1500, the same level at which they have been for the past twenty years, even though treatment costs have increased. If, for example, you receive one crown, a root canal, and 2 dental cleanings in one year, the portion paid by most insurance companies will likely come close to (and may even exceed) $1500, so any other treatment fees you incur will be your responsibility.